Take Control of Your Finances!!

The Monthly Budget Planner That Transforms Money Management

Introduction

Have you ever checked your bank account at the end of the month and wondered, Where did all my money go? If so, you’re not alone. The truth is, that most people struggle with keeping track of their income and expenses. They have good intentions — maybe even a mental list of things they should be saving for — but without a structured plan, financial goals remain just that: goals.

I know this because I’ve been there. Watching my money slip through my fingers, overspending on things I didn’t need, and constantly wondering why I couldn’t save enough. That’s exactly why I created the Monthly Budget Planner — a simple yet powerful tool to bring financial clarity and discipline into your life.

If you’re tired of financial stress, impulse spending, and having no idea where your money goes each month, keep reading. This planner is about to change the way you think about money forever.

The Problem: Why Most People Struggle with Money Management

Managing money isn’t just about knowing how much you make and spend — it’s about controlling it. And yet, so many people run into the same issues:

They don’t track expenses — Small purchases add up quickly, but without tracking, it’s impossible to know where cuts can be made.

They set unrealistic savings goals — Saying you’ll save “more money” isn’t a plan. Without a clear target, savings often don’t happen.

They lack a budgeting system — Without an organised way to allocate income toward bills, debt, savings, and expenses, financial chaos ensues.

I wanted a solution that would help people not only understand their financial habits but also take charge of their money. That’s how the Monthly Budget Planner was born.

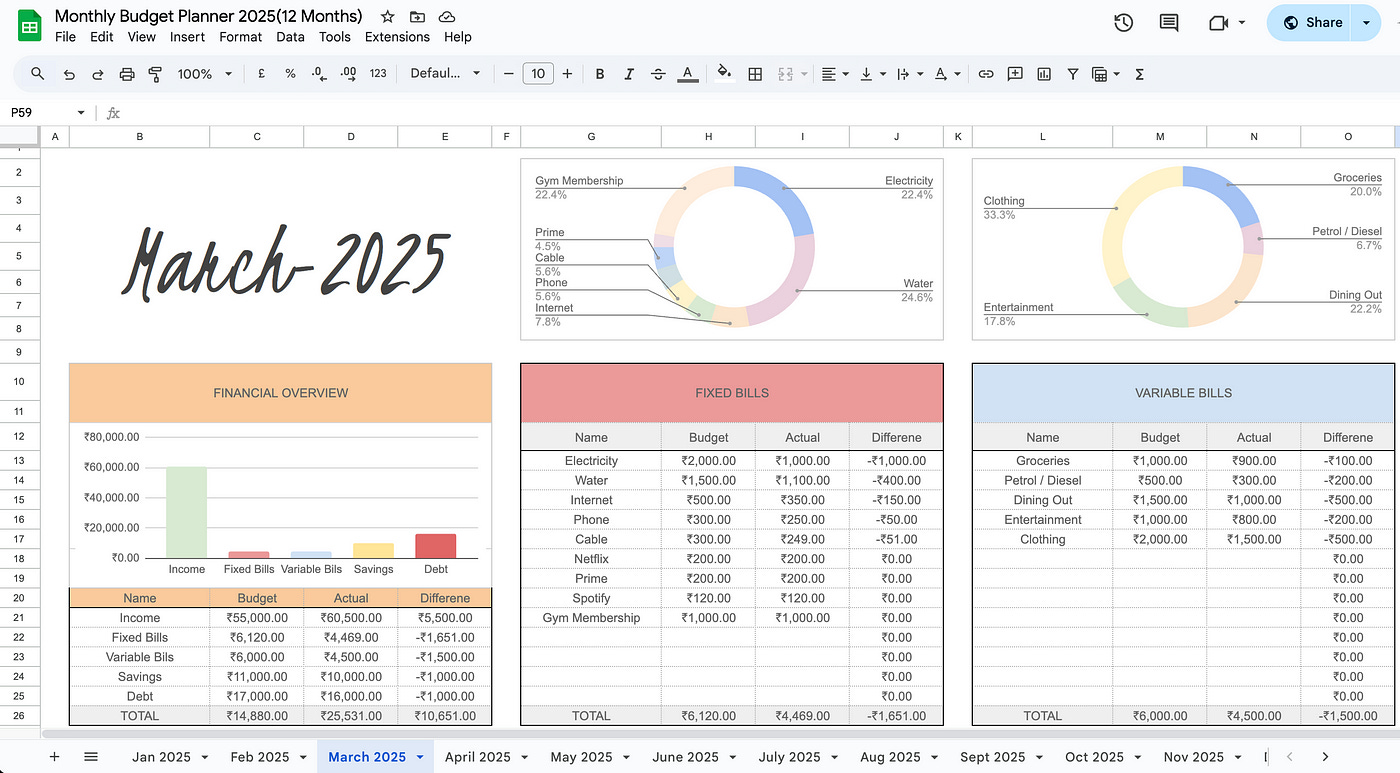

The Solution: A Budget Planner That Works For You

This planner isn’t just another financial notebook — it’s a game-changer. I designed it with simplicity, effectiveness, and flexibility in mind, ensuring that anyone — whether you’re a student, entrepreneur, or professional — can use it successfully.

🔹 What Makes This Planner Special?

✅ Holistic Budgeting Approach — Everything is covered: income, savings, fixed expenses, variable expenses, and even emergency funds.

✅ Goal-Oriented Planning — You’re not just tracking; you’re planning! Set clear savings goals and work toward them each month.

✅ Smart Spending Sections — Understand where your money actually goes so you can make smarter spending choices.

✅ Undated & Customizable — Start anytime and tailor it to suit your specific financial needs.

✅ Perfect for Everyone — Whether you’re managing a single income, tracking multiple streams, or trying to get out of debt, this planner simplifies everything.

How This Planner Can Help You Save 50% More

I’ve seen firsthand how this budgeting system can increase savings by 50% or more. How? It all comes down to three major benefits:

🔹 Awareness — When you see where your money is going, it’s easier to cut back on unnecessary spending.

🔹 Accountability — Writing things down keeps you conscious of your financial choices. Every purchase has to be justified.

🔹 Adjustment — You’ll naturally start shifting money toward the things that matter (like savings and investments) instead of mindless spending.

Imagine being able to save twice as much for that dream vacation, a new laptop, or an emergency fund — just by tracking and tweaking your spending habits!

Why Budgeting Isn’t Just About Cutting Costs

Many people assume budgeting means depriving yourself of things you enjoy. But the opposite is true. Budgeting is about making conscious choices so you can spend money where it truly matters.

When you have a plan in place, you: ✔ Spend on things that align with your priorities ✔ Eliminate guilt over purchases ✔ Build long-term wealth without feeling restricted

It’s about control, not limitation.

How to Use the Monthly Budget Planner Effectively

1️⃣ Start with Income — Write down every source of income, from your salary to side gigs. Knowing what you actually earn each month is key.

2️⃣ Track Fixed Expenses — These are things like rent, utilities, and subscriptions — expenses that remain the same every month.

3️⃣ List Variable Expenses — Things like groceries, dining out, and shopping. This is where you can often cut back and save!

4️⃣ Set Savings Goals — How much do you want to save? Break it down into realistic targets.

5️⃣ Review & Adjust — Check in weekly to stay on track and adjust as needed.

Final Thoughts: Your Financial Future Starts Today

Most people don’t fail at saving money because they’re bad at it. They fail because they don’t have a system in place. The Monthly Budget Planner is that system — a roadmap to financial security and peace of mind.

If you’re ready to break free from financial stress and take control of your money, this planner is for you.

📢 Order now and start your journey toward financial freedom! 🚀

🎯Monthly Budget Planner

Let’s make smarter money moves together! 💰✨

#Budgeting #FinancialFreedom #SmartMoneyMoves #Savings #MoneyManagement #Planner #PersonalFinance